This interview will help you determine if you should file an application to receive an individual taxpayer identification number (ITIN). An ITIN is a tax processing number, issued by the Internal Revenue Service, for certain resident and nonresident aliens, their spouses, and their dependents. This means that anyone who is required to file taxes in the U.S. will be eligible for an ITIN, no matter their immigration status. An ITIN may be assigned to an alien dependent from Canada or Mexico if that dependent qualifies a taxpayer for a child or dependent care credit (claimed on Form 2441). The Form 2441 must be attached to Form W-7 along with the U.S. federal tax return.

This number keeps track of the years you’ve worked in the U.S. and your lifetime earnings. Once you apply for an ITIN, you can expect to hear from the IRS about the status of your retired software from palo alto software application within seven weeks. Anyone who earns income from the U.S. is required to get a tax ID number, since they’re obligated to pay taxes on what they earn. Like Social Security numbers, the ITIN is also nine digits long.

- All Form W-7 applications, including renewals, must include a U.S. federal tax return unless you meet an exception to the filing requirement.

- For more information please see the Social Security Administration website.

- If you are not a U.S. citizen and do not have a Social Security number, learn how to get and use an Individual Taxpayer Identification Number (ITIN) to file a federal tax return.

- If you’re a qualifying non-resident or a resident alien (green card holder), you, your spouse, and your dependents can receive an ITIN.

Individual Taxpayer Identification Number

As the name implies, an ITIN is a dedicated tax ID number that allows individuals to report their earnings, expenses and deductions to the IRS. These unique numbers are reserved for U.S. taxpayers who are unable to obtain a traditional Social Security number. Note, however, that having an ITIN doesn’t necessarily qualify one to work or reside in the United States. To obtain an ITIN, you must complete IRS Form W-7, IRS Application for Individual Taxpayer Identification Number.

If you need to renew your ITIN, you’ll follow the same process as applying for a new ITIN. However, if you mail in your renewal application, you can simply send along a form W-7 with supporting documents—no need to attach a tax return. Applicants who meet one of the exceptions to the requirement to file a tax return (see the Instructions for Form W-7) must provide documentation to support the exception. Assuming you qualify for an Individual Taxpayer Identification Number (and you follow the W-7 form instructions correctly), you should receive an ITIN within seven weeks. But due to potential processing delays, it’s advisable that you add some extra wiggle room. This is especially true if you’re mailing your ITIN application to the U.S. from overseas as an expat or non-resident.

Get an Individual Taxpayer Identification Number (ITIN) to file your tax return

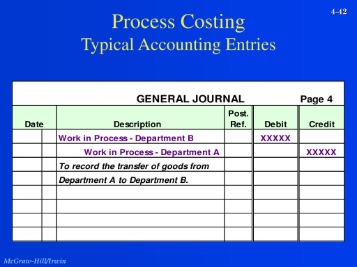

All Form W-7 applications, including renewals, must include a U.S. federal tax return cost variance formula and analysis how to calculate cost variance video and lesson transcript unless you meet an exception to the filing requirement. You can apply for an ITIN any time during the year when you have a filing or reporting requirement. At a minimum, you should complete Form W-7 when you are ready to file your federal income tax return by the return’s prescribed due date.

For federal agencies

The application must be attached to a valid federal income tax return unless the individual qualifies for an exception. If questions 11 through 17 on Form SS-4 do not apply to the applicant because he has no U.S. tax return filing requirement, such questions should be annotated “N/A”. A foreign entity that completes Form SS-4 in the manner described above should be entered into IRS records as not having a filing requirement for any U.S. tax returns. Failure to respond to the IRS letter may result in a procedural assessment of tax by the IRS against the foreign entity.

The Form W-7 requires documentation substantiating foreign/alien status and true identity for each individual. You may either mail the documentation, along with the Form W-7, to the address shown in the Form W-7 Instructions, present it at IRS walk-in offices, or process your application through an Acceptance Agent authorized by the IRS. Form W-7(SP), Solicitud de Número de Identificación Personal del Contribuyente del Servicio de Impuestos Internos is available for use by Spanish speakers. An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service. Anyone who needs to file a U.S. tax return can get an ITIN, regardless of their U.S. immigration status. When you open a checking account or a savings account, you’ll need to verify your identity.

You also must submit evidence of your identity, age, and U.S. citizenship or lawful alien status. For more information please see the Social Security Administration website. The IRS what are the average bookkeeping rates andfees for small businesses clarifies that you need either an ITIN or an SSN to get the Child Tax Credit. Of course, you’ll only receive that credit if meet the other reporting requirements for it.

An Employer Identification Number (EIN) is also known as a federal tax identification number, and is used to identify a business entity. It is also used by estates and trusts which have income which is required to be reported on Form 1041, U.S. Refer to Employer ID Numbers for more information.The following form is available only to employers located in Puerto Rico, Solicitud de Número de Identificación Patronal (EIN) SS-4PR PDF. ITIN holders must verify their identity through the video chat process and will need a valid email address, proof of ITIN, one primary document and one secondary document. An Individual Taxpayer Identification Number is a tax processing number issued by the IRS. The purpose of an ITIN is to ensure those who work in the U.S. have a method of paying taxes, even if they don’t qualify for a Social Security number (SSN) from the Social Security Administration.