Furthermore, virtual assistance agencies often have established processes and procedures in place, ensuring that your bookkeeping tasks are performed efficiently and accurately. It brings cost-effectiveness, as you only pay for the services you require. Additionally, you can scale up or down your bookkeeping support as needed. A Chief Financial Officer (CFO) typically handles these responsibilities in large companies, but many accounting firms also offer virtual CFO services as part of their offerings.

Tracking Cash Flow: Purchases And Inventory

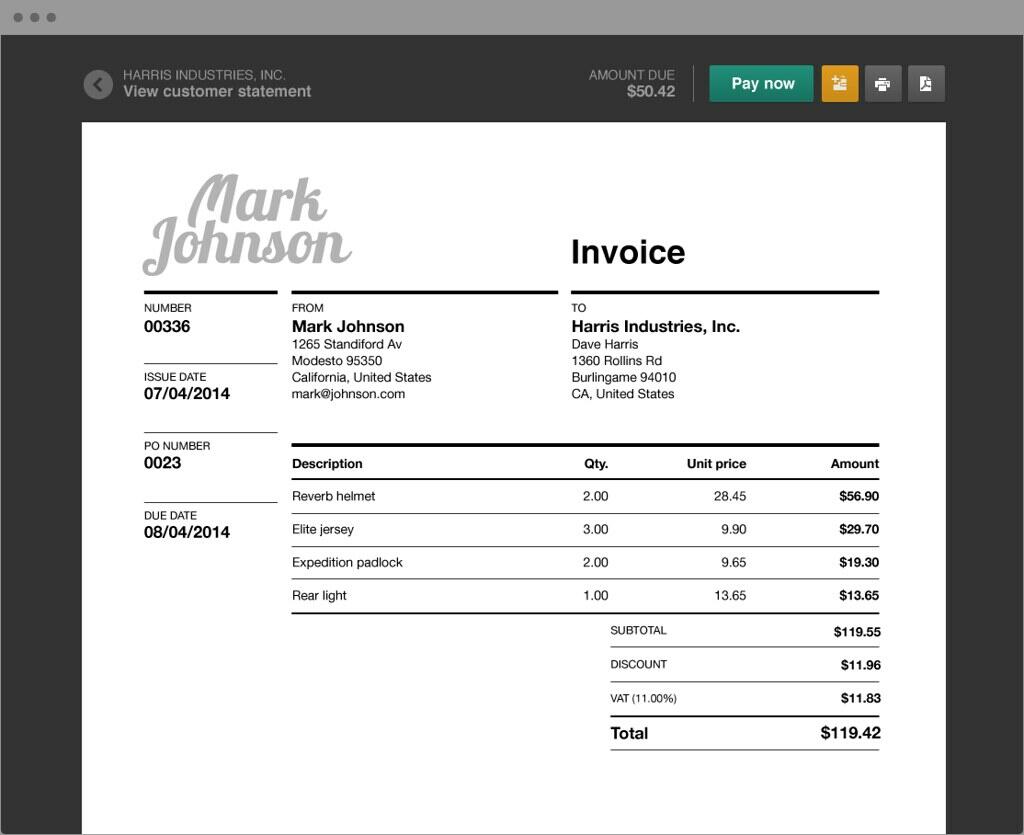

This financial information reveals insights into where you’re spending money and how your business makes revenue. Also, having detailed financial records makes tax season less of a headache. They can easily handle tasks like tracking sales and expenses and preparing financial reports. Plus, onboarding an e-commerce bookkeeper frees up a lot of time for business owners. This means they can focus more on growing their business instead of worrying about finances. We are sure you must be thinking about why e-commerce looking is essential.

Accounting and Tax Services

Start by determining how you’ll log your inventory and whether you’ll use the FIFO, LIFO, or average cost valuation method. Then use an inventory management system to accurately track your inventory, and make sure you audit it on a regular basis. It is important to note that COGS are different from your operating expenses, which are expenditures not directly related to the production of your products. While they are both subtracted from your business’s total sales figures, they should be recorded separately. The first in, first out method assumes items purchased or produced first are sold or used first. With this system, the oldest inventory items are recorded as sold before newer ones.

Backing Up Data

Cash flow refers to the amount of money “flowing” in and out of a business on a monthly, quarterly, or annual basis. When you know exactly how much money is passing through your business, it enables you to maintain a positive profit margin. If you suffer a loss, your cash flow statement pinpoints where overspending occurred so you can strategize to reverse the trend. The margin between your cost of goods sold and net profit should be stable as well as predictable. And always remember to record your cost of goods sold when you sell each piece of inventory. Using a break even point calculator can help you determine if your sales will be enough to cover your costs and to what degree.

Websites such as Upwork, Freelancer, and Fiverr host numerous freelance professionals specializing in bookkeeping services. When it comes to hiring e-commerce bookkeepers, you have several options to consider. Whether you’re looking for in-house employees or seeking assistance from bookkeeping services or freelancers, there are multiple avenues to explore.

- Ecommerce accounting is the practice of recording, organizing, and managing all of the financial data and transactions relevant to the operation of an ecommerce company.

- It also allows you to predict when you will need to restock, order supplies, and adjust your pricing strategy, if necessary.

- It is important to note that COGS are different from your operating expenses, which are expenditures not directly related to the production of your products.

- Tax money is not the same as revenue; it’s a liability that you owe the government.

- Get free ecommerce tips, inspiration, and resources delivered directly to your inbox.

Ensure that appropriate security measures are in place, such as encryption, secure data transfer protocols, and confidentiality agreements. Regularly review and evaluate your operating expenses to identify potential areas for cost reduction or optimization. Consider negotiating better deals with suppliers or streamlining inefficient processes. Set up your Shopify tax settings to align with the tax requirements of your business’s jurisdiction. Define tax rates, exemptions, and collection rules based on customer location and applicable tax laws. These services allow you to interact with your bookkeeper through email, phone, or video conferencing.

This is the difference between a company’s total revenue and its cost of goods sold. It represents the initial profit before other expenses such as taxes, marketing, rent, etc. When you think of accounting, your mind probably goes straight to taxes, but that’s only part of what ecommerce business accounting entails. Businesses that document their processes grow faster and make more profit. Download our free checklist to get all of the essential ecommerce bookkeeping processes you need every week, month, quarter, and year. Foreign transaction fees present an entirely different kind of issue for eCommerce.

- Thus, launching and managing a small business is often a juggling act, consuming vast amounts of time, even for seasoned entrepreneurs.

- However, a few best practices can help you gain even greater visibility into your business’s finances.

- Utilize features like bulk import/export to streamline data entry processes.

- However, many accounting firms will also offer bookkeeping services.

Tax Considerations for Ecommerce Businesses

The following financial statements are vital for a business’s finances. You didn’t start your ecommerce business so you could juggle accounts and balance books. You started it to sell products, serve customers, and make money while you’re at it. But ecommerce bookkeeping is a necessary and important part of keeping your accounts in good shape. Basically, bookkeeping is the process of tracking the money that goes in and out of your business. When it comes to bookkeeping and accounting, the operation of an e-commerce business is not much different from running a conventional retail shop.

What is ecommerce bookkeeping?

- An accounting program can track how many units were sold or if you’ve turned a profit.

- They also provide a great resource for potential investors who can see the financials of your business over time.

- Therefore, your books need to reflect the difference between gross sales, sales tax, merchant fees, and the final deposit on your bank statement.

- Tax management can be complicated, and mistakes in filing or interpreting the tax code can have serious consequences for business owners.

- For example, you need to note that you sold “x” number of sweatshirts at “y” price per sweatshirt.

- Handling COGS, inventory adjustments, sales tax intricacies, and meticulous reconciliations, we ensure your accounting is as streamlined as your ecommerce operation.

This means that, even with the extra expense of a bookkeeper and/or accountant, you’ll still have to pay for accounting software, greatly increasing the cost of tracking your data. Standard bookkeeping simply means keeping track of ecommerce bookkeeping the incoming and outgoing flow of money for your business. This same definition applies to eCommerce bookkeeping, though the best ways of bookkeeping for a brick-and-mortar store can differ drastically for an eCommerce business.