Content

Earn 5% cash return to your everyday orders in the different locations for each one-fourth, as much as the fresh quarterly limitation after you turn on. This could determine and therefore items we remark and you may share (and you will where those people points show up on your website), nonetheless it never has an effect on the guidance otherwise guidance, that are grounded in the hundreds of hours from research. Our very own couples never pay us to make certain advantageous analysis of their goods and services.

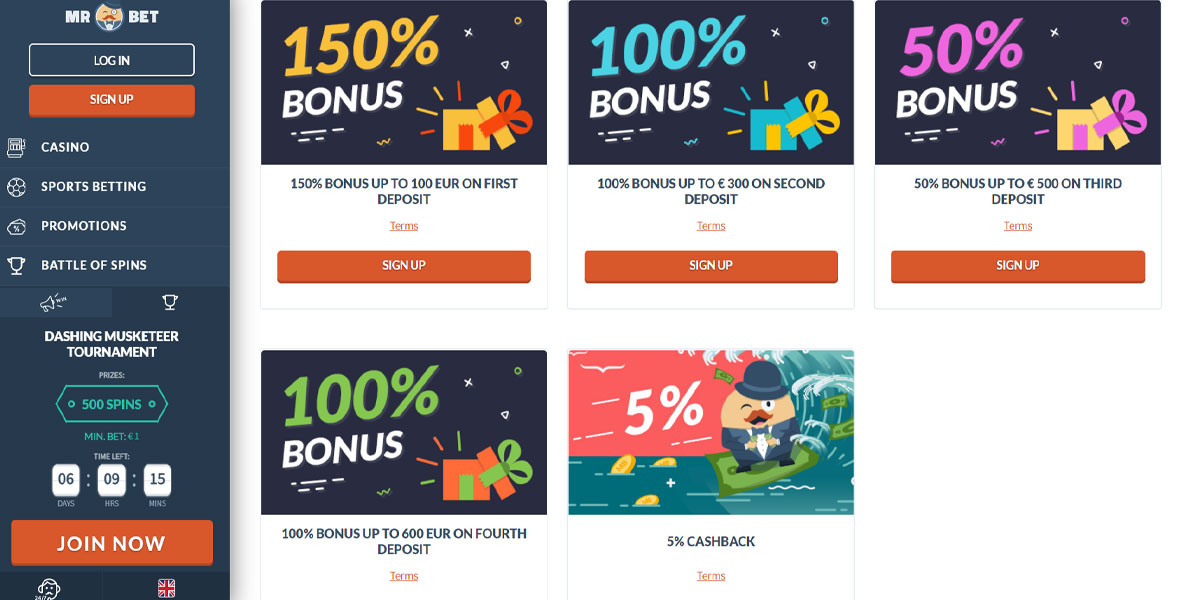

You can also get benefits for the money straight back otherwise a statement borrowing in your membership in every matter, even although you have only a number of cash inside the advantages in order to burn off. Which have this kind of independence inside the a benefits program mode you’ll never score stuck having benefits you could’t explore. At the same time, unlike providing a timeless greeting incentive that really needs you to definitely see the https://mrbetlogin.com/black-jack-pro-series-low-limit/ absolute minimum using demands, Discover often match all the rewards you earn at the bottom of your first year with its Cashback Matches program. Once more, these types of advantages are not in the amount of far more superior offerings, however, I believe they’re ideal for novices to help you handmade cards. There is no limitation to help you simply how much you can generate for the cash-back fits at the end of very first season, which means your income is effortlessly twofold immediately after 12 months.

Editorial Versatility

That it forgiving commission framework may make the fresh cards a better match if you’re also still new in order to credit cards otherwise have experienced a hard day managing repayment dates before. In my opinion, the newest Might find Chrome is not the best bet to have increasing cash-straight back advantages, while the $1,100000 every quarter cap to the 2% added bonus money to have energy station and you may bistro sales oceans down its prospective. But not, individuals who can make by far the most of the first-season cash-back match provide or beginners looking for simple redemption possibilities you will see so it zero-annual-fee cards useful. The brand new Might find Cash return have zero foreign exchange fees, that’s helpful for anyone who apparently travel worldwide. In addition to, cardholders discovered a basic 0% Annual percentage rate to the the new requests for the earliest 15 months (immediately after, 18.49% in order to 27.49% varying Apr). After you’ve activated the main benefit groups, you could potentially store once you understand you’lso are earning a great moved-upwards benefits price.

The finest picks from fast offers from our couples

The fresh May find Safeguarded Charge card is a wonderful option for those people strengthening or reconstructing their borrowing and offers a very clear street so you can at some point upgrade so you can an enthusiastic unsecured card. Along with, like all Come across cards, it comes having an attractive greeting give. Discover often fits all of the kilometers you earn within the first 12 months no minimum spending demands otherwise cap on the fits. Outside these characteristics, the newest cards is extremely just as the standard Might discover Dollars Straight back. It’s got Public Protection amount keeping track of and you can totally free entry to your own FICO rating.

Moreover it shines for its novel acceptance bonus, and this suits the rewards you’ve gained after very first 12 months. The brand new cards along with has an extended basic Apr give and you will user protection equipment to own cardholders. There’s you to quick (however, crucial) action to help you safer a complete 5% cash return regarding the Could find Cash return’s extra categories. To earn 5% instead of the fundamental 1% given to your all of the sales, you’ll must activate the brand new rotating added bonus classes every quarter. A cash back credit card lets you generate profits back benefits while the a portion of one’s count you may spend.

This may be started me personally straight back at the beginning of conversing with the brand new va, and that i destroyed exactly what nothing advances I’d produced conversing with the initial broker I got until the app closed-out for the me. I have been charged $70 inside overdraft charges from their store delivering funds from the wrong membership which i clearly advised him or her never to perform again the fresh first time which took place. I am paying off my credit by the mobile money as a result of my work membership on my standard account, that i shouldn’t should do since i have paid off them alright inside the during the last, and then closing my membership with this particular horrid team. Because the Might find Money back and Chase Versatility Bend share some great benefits of worthwhile rotating added bonus kinds, the new Liberty Flex is a far greater total earner while the cardholders and rating step 3% to 5% to the fixed bonus groups. The new Versatility Flex doesn’t provide a first-season bucks-back match however it does come with a powerful $200 added bonus just after spending $500 to your purchases in the first ninety days out of account opening.

Get Cashback Extra to invest one part of the bill, including your minimal commission. You are able to nevertheless earn an unlimited step 1% cash return for the any other requests – automatically. As well as, there are many more, arguably greatest, possibilities to possess generating elevated cash return for no annual percentage (more on such after).

The brand new credit has no annual payment and you will an optional credit history with a minimum of 670. Read on to learn more about the brand new May find Chrome to find out if it’s well worth adding to your own wallet. Robin has worked since the a charge cards, publisher and you will spokesperson for more than ten years. Just before Forbes Mentor, she in addition to secure handmade cards and relevant articles for other federal web courses along with United states Now, NerdWallet, Bankrate and HerMoney.

Comparable applications

Factual statements about the newest Could find Equilibrium Import might have been collected separately by the Come across and has maybe not started assessed or provided with the newest issuer of your own credit earlier to publication. Earn 5% Cashback Bonus to the to $step 1,500 in almost any classification purchases per quarter, when you trigger. In addition to, you usually secure Cashback Added bonus to the purchases if you are using your own Find credit. We set-aside the right to dictate the process in order to disburse your own benefits balance. We’re going to borrowing from the bank your bank account otherwise deliver a seek advice from your own rewards equilibrium if your Membership is actually closed or if you haven’t used it within 18 months. And you’ll however earn limitless step 1% cash return for the any other purchases outside the 5% system.

Don’t spend cash you wouldn’t or even, however, possibly to shop for what you need out of a different shop is also assist your orders slide within another class. Getting obvious, some playing cards offer much more pros than just Come across. And when traveling- or get-related pros are at the top of their priority list, a take a look at cards may possibly not be the right mastercard device for your requirements. A gas credit card may offer a higher portion of bucks straight back on the gas channel sales, and non-gasoline get in the station’s convenience store. Eventually, understand that so it credit’s introduction Annual percentage rate render just is applicable for a finite some time which you’ll need to pay the new large adjustable Apr up coming.