Such insights can only be gained with the proper application of the concept of the activity base. The right activity base should reflect the critical operational activities contributing to resource usage. For instance, for a manufacturing company, the activity base might be the number of units produced. On the other hand, for a logistics company, it could be the number of miles driven. By measures the resources used per unit of the activity base, it gives a clear insight into the sustainability performance within the context of operational activities.

Introduction to the Activity-Based Costing (ABC) Model

The model then attributes these costs to products based on how much the product uses the activity, causing the cost. That way, the Activity-Based Costing method singles out activities with high oevrheads per unit and points out areas where management needs to reduce costs or find a way to charge more for the product. The traditional method of cost allocation assumes that all products consume resources at the same rate, often leading to inaccurate cost calculation. Activity Base is an intrinsic part of the Activity-Based Costing (ABC) method. This method suggests that costs should be allocated according to the activities directly involved in the production of a product or provision of a service, and activity base plays a pivotal role in making this possible. Of the total costs, direct material and direct labor were traceable directly to the product cost object.

Human Capital Management: Understanding the Value of Your Workforce

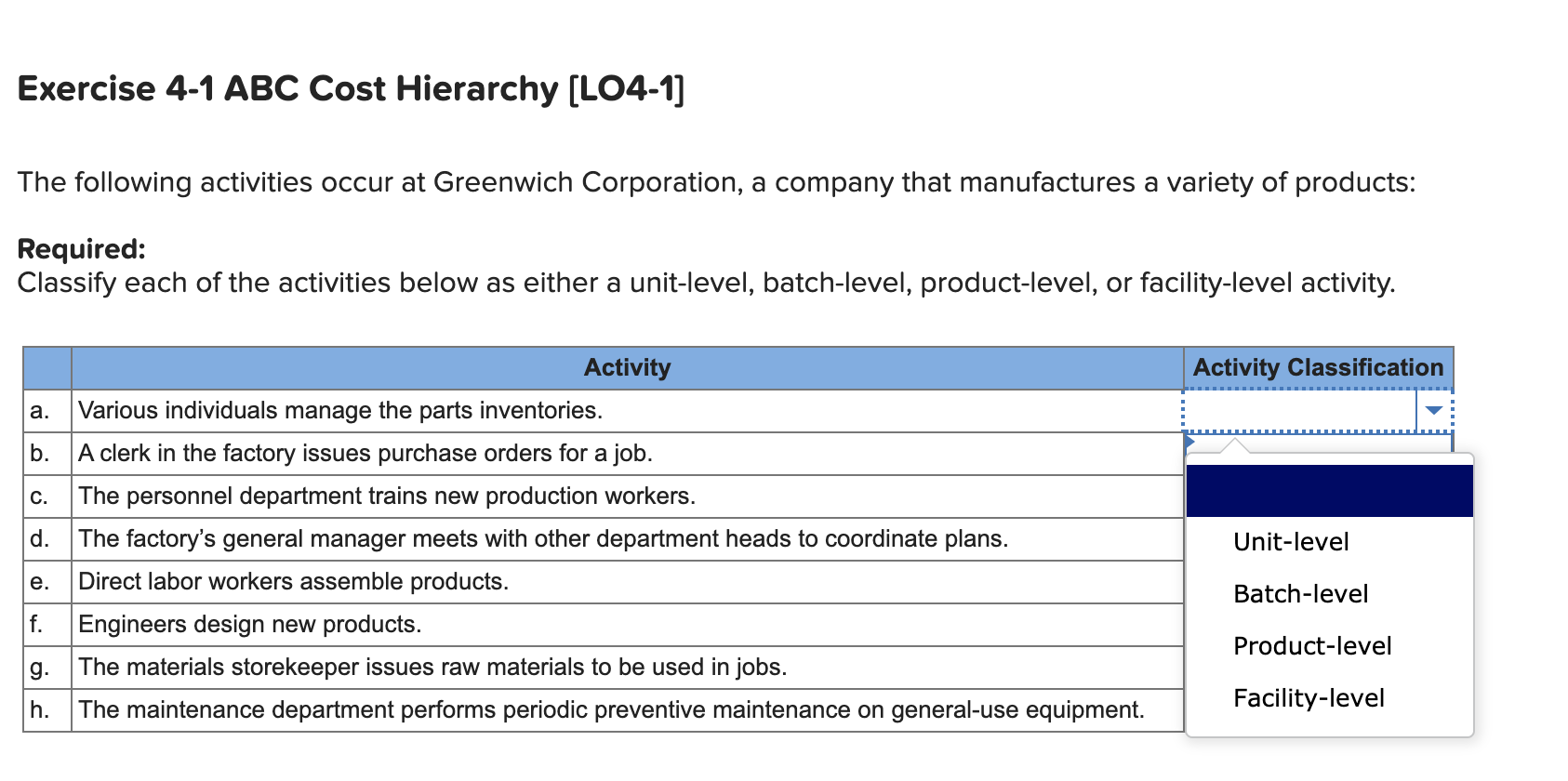

You believe that the benefits of activity-based costing system exceeds its costs, so you sat down with Aaron Mason, the chief engineer, to identify the activities which the firm undertakes in its sofa division. Next, you calculated the total cost that goes into each activity, identified the cost driver that is most relevant to each activity and calculated the activity rate. Unit-level activities are activities that are related to producing each unit. This is unlike batch-level activities that happen every time a batch of products are produced. Unit-level activities are those that support making each individual unit, while batch-level include a group of units. The ABC method is a costly approach that recognizes the relationship between produced goods, costs, and overheads.

What are Batch-Level Activities?

As an activity-based costing example, consider Company ABC that has a $50,000 per year electricity bill. For the year, there were 2,500 labor hours worked, which in this example is the cost driver. Consider that traditional costing methods divide costs into product costs and period costs. The period costs include selling, general, and administrative items that are charged against income in the period incurred.

The Activity-Based Costing aids the costing process of the company by extending the cost pools used to analyze overheads and linking indirect costs to specific activities. The variation in your product or service offerings can significantly affect the choice of activity base. Companies offering a wide range of diverse products or services might need to consider multiple activity bases. This is because different products or services can have disparate costs links. For example, a software company might measure costs for one product based on ‘code lines written’, and ‘hours of customer support’ for another product. Under traditional approaches, some idle capacity may be incorporated into the overhead allocation rates, thereby potentially distorting the cost of specific output.

- Examples of these batch-level cost drivers can often include machine setups, maintenance, purchase orders, and quality tests.

- Beyond the orientation towards sustainable business practices, an activity base has further implications for how a business interacts with its stakeholders, which is central to the broader concept of CSR.

- Batch-level activities are production tasks or processes that occur each time a batch or group of similar products is produced, regardless of the number of units within the batch.

- These costs typically remain constant over time and do not change with the level of production.

However, the service industry can apply the same principles to improve its cost management. Direct material and direct labor costs range from nonexistent to minimal in the service industry, which makes the overhead application even more important. The number and types of cost pools may be completely different in the service industry as compared to the manufacturing industry. For example, the health-care industry may have different overhead costs and cost drivers for the treatment of illnesses than they have for injuries. Some of the overhead related to monitoring a patient’s health status may overlap, but most of the overhead related to diagnosis and treatment differ from each other. Apart from the allocation of overhead costs and determining overhead rates, the activity base also directly contributes to the process of calculating the cost of goods sold (COGS).

Finally, ABC alters the nature of several indirect costs, making costs previously considered indirect—such as depreciation, utilities, or salaries—traceable to certain activities. Alternatively, ABC transfers overhead costs from high-volume products to low-volume products, raising the unit cost of low-volume products. Consequently, managers were making decisions based on inaccurate data especially where there are multiple products. In a business organization, the ABC methodology assigns an organization’s resource costs through activities to the products and services provided to its customers. Comparing to the traditional costing approach (EUR 0.29 per unit), we see that applying ABC for such a small batch gives us an almost double overhead cost per unit. Such discrepancy can indicate that the product is underpriced and subsidized by another product, as only about half of the overheads go into the pricing process.

Kohler introduced the concept of accounting for the costs of these processes by accurately assessing the activities involved in carrying them out. Certain activities, such as maintenance or quality control, can oftentimes be accounted for in multiple levels of activity-based costing. The sales price was set after management reviewed the product cost with traditional allocation batch-level activity along with other factors such as competition and product demand. The current sales price, cost of each product using ABC, and the resulting gross profit are shown in Figure 9.16. Take machine hours as an example – machine operating hours drive power costs and maintenance costs. Financial analysts mostly use the model in costing, pricing and profitability analysis.